February means it’s tax season and in 2016 you have until

Monday, April 18th to file without facing penalties. For many of us

doing our civic duty is a bit of a pain; sure it’s nice driving on public

streets, sending the kids to public schools, and living in a generally stable

society, but why do I have to pay so

much of the burden? The answer is: you don’t!

There was a time in America when saving for retirement

wasn’t financially viable. A century and a half ago “poorhouses” existed to

take in the infirm who, after a lifetime of working 80 hour weeks doing manual

labor for a meager existence, found themselves destitute and incapable of

generating additional income. They were sent off to live alone, under-cared for,

and impoverished until they died. Luckily a horrified nation decided, “We can

do better.”

The end result featured a strengthening of things like

pensions and the creation of Social Security. Eventually the government decided

there was a benefit for society in creating programs that incentivized people

to save for the future privately as well. The best way to incentivize them? Pay

them money! That’s how the 401k was invented.

What is a 401k?

Named after the portion of the tax code that legalizes it, a

401k is an employer-offered retirement savings plan that allows you to save and

invest money for retirement. Why not just set up a retirement savings account

on your own? Because a 401k offers two special benefits you won’t get from your

own savings account:

- Employer matching where your employer gives you extra money on top of your salary to save into your 401k, generating an immediate profit on your investment

- Tax advantaged savings

Enter the government

With the need to incentivize their citizens to save for retirement

the government allowed businesses to create retirement accounts for their

employees as an incentive to work for one company over another. After all, if

Company A offered you $50,000/year in salary with no 401k but Company B offered

you $50,000/year plus a 401k matching

incentive of 5%, you’d make 5% more money working for Company B than you would

for Company A. Which place would you

rather work at?

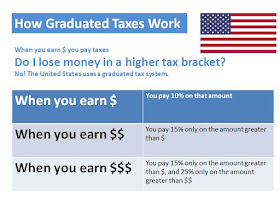

But the government took things a step further by introducing

a second means of saving: tax advantages. On normal income you earn, you pay

taxes. Most Bill Stark Blog readers are in the 10%, 15%, or 25% tax brackets

meaning they earn somewhere between $0-$91,150. At the 25% bracket for every

$1,000 you earn you pay $250 in taxes, netting you $750 of income. When you put

money into your 401k instead of directly into your bank account? The government

excuses your tax payment and lets you keep 100% of that money.

Consider it like this: if you make $50,000 a year, the

government taxes you for earning $50,000. But if you put $5,000 into your 401k

the government gives you a break and taxes you for only $45,000 of income, even

though you really earned $50,000. Remember, by essentially “giving” you money to

save for retirement the government helps to ensure it won’t have to take care

of you when you’re too old to work and broke from not saving.

In addition to giving you your investment tax free the

government offers you a second tax advantage with your 401k: no taxes on

investment growth in the account. That means when you invest your 401k every dollar

you earn in that account also goes

without being taxed netting you even more

in gains over a regular investment account (what should you be investing in? Find out here!). It’s called a double tax advantage because you save taxes on

the way into the account and while the money is invested in the account.

Eventually you’ll pay taxes on the amount you withdraw from the account but

only after years of accumulation of tax-free interest. Plus, it’s likely you’ll

pay a lower tax rate in retirement than you do while you’re working. The 401k

is an incredibly powerful savings tool (in fact, there’s only one that’s more powerful and only if your employer doesn’t offer a

401k match!).

Still not convinced? Let’s look at the cost of not saving in your 401k.

The costs of not using your 401k

Barbara and Edward both work for the same company. They each

earn $100,000/year, they each pay 25% as their top tax rate, and each has the

chance to earn a 6% match on their 401k from the company. Barbara opts to take

advantage of the program, but Edward figures he can always save for retirement “later”

and would rather spend his money on things he can enjoy right now. Let’s look at how that plays out for them.

The maximum amount the IRS allows you to invest each year

into a 401k is $18,000. (This number goes up over time to account for

inflation, but to make this story easier to tell we’re going to simply leave it

at $18,000). Barbara decides to max out her 401k setting aside the full $18,000

from her income. Each paycheck her employer takes a percentage of her income

and puts it into the account for her, plus an extra 6% per their agreement. She opts to invest the funds which grow tax free. Her investment in an S&P

500 index historically returns 10%, but we’re going to calculate her returns at

7% as a hedge against a bad 20 years and to account for inflation. While

Barbara is doing all this, Edward buys a boat.

In the first year of investing here’s how Barbara and Edward

do.

After a year of saving Barbara has a pretty nice little nest

egg built up. The market only got her a few hundred dollars in investment

earnings at 7% but she got the employer match and saved $4,500 in taxes. Edward

has a boat. But there are a lot of years left of saving into that 401k. Barbara

keeps socking away money for the next two decades while Edward keeps putting it

off, saying he’ll save for retirement later (and going on boat trips). What

does 20 years of saving look like compared to boat trips?

What a difference! During their 20 year careers Barbara

accumulates over $1,000,000 in wealth by saving into her 401k! Meanwhile Edward

had to pay $90,000 in taxes to keep his full salary, lost out on $120,000 in

extra income from his employer, and missed out on over half a million dollars

on investment earnings! He did, however, take those trips on his boat. After 20 years of working without saving for retirement Edward realizes too

late he needs to start putting money away. He decides to sell his boat and

start taking advantage of the 401k. Barbara, content with her savings, opts to

retire early. She buys a used boat from a coworker at a heavily discounted rate

(he said he needed the cash for retirement) and enjoys not working anymore from

the bow of her ship, martini in hand.

Maximizing your savings

How does that impact you? Right now if you have access to a

401k but you don’t maximize it you’re losing money in taxes that could have

gone elsewhere instead. The long-term impact of that decision? You lose out on

as much as $1,000,000 in wealth!

Don’t make that mistake. If your employer offers you a 401k

take advantage of it by putting aside whatever money you can afford. There’s a

reason The 10 Step Plan puts getting your 401k match as one of the very first steps.

You’re potentially missing out on thousands of dollars from your employer and the United States government! As

much as $1,000,000 in lifelong wealth, potentially more! Take advantage of your

401k today (and if you’re not in a place to put away the full $18,000/year yet,

don’t beat yourself up: put away what you can afford and find out how you can cut expenses to put away even more).

ReplyDeletethanks for the info. This is in accordance with the information provided. The 401k Plan is the best alternative when it comes to thinking about the future after having worked for many years. I will follow the Serca Blog because I found the information published here very interesting.